Carbon Capture, Utilisation, and Storage (CCUS) is increasingly recognised as a critical technology in achieving net-zero emissions. The IEA states that “reaching net zero will be virtually impossible without CCUS. The technology plays a major role in the transition, especially for sectors where emissions are hard to abate and in delivering negative emissions”[1].

However, one of the main challenges to the widespread implementation of CCUS is the relatively high upfront investment cost, especially for CO2 capture plants. Investors who commit to investing in CCUS want a return on investment. This return can be achieved through a revenue stream for capturing CO2, a commercially lucrative utilisation of CO2 or the avoidance of a carbon tax or penalty (for CO2 emissions). Therefore, the key to commercialising CCUS lies in assigning a price to CO2 emissions that exceeds the cost of capturing and storing CO2 or by finding a creative way to turn CO2 into a useful product (utilisation).

Different governments around the world are utilising different policy levers to encourage the creation of a CCUS market. Some governments are wielding a “stick” approach whereby they impose a carbon tax or penalties for emissions, while others are adopting a “carrot” approach, such as providing tax credits, subsidies, or other forms of financial support for CCUS initiatives. Some governments, such as the European countries, are using both the “carrot” and “stick”. For example, the establishment of a high carbon tax in Norway in 1991 “effectively gave birth to the CCUS industry in the country”[2]. The high carbon tax spurred the development of the world’s first industrial-scale CO2 injection project at the Sleipner field for Equinor, formerly Statoil, to avoid paying the hefty carbon tax. Norway also provided government support and funding to CCUS projects to overcome the commercial barriers to investment.

In addition to supportive regulatory and commercial incentives, public acceptance is also crucial for the successful development and implementation of CCUS projects. Without broad public support, CCUS projects may face significant opposition, delays or even cancellation, as was the case in Barendrecht in the Netherlands[3]. Public acceptance can drive policy decisions, secure funding and facilitate smoother project implementation by reducing resistance from local communities and stakeholders.

As highlighted earlier, the implementation of CCUS is being approached differently by each country, utilising distinct policy and regulatory levers. Consequently, companies looking to invest in CCUS projects must navigate these unique environments and tailor their commercial strategies to align with the specific regulations and incentives of the country in question. As a result, there is no one-size-fits-all solution and, therefore, companies must develop a strategy that is both robust and fit for purpose within the local context. Engaging the expertise of consultancies such as Ad Terra can provide expertise and guidance in developing a robust CCUS commercial strategy optimised for the target country’s specific regulatory and market conditions. For example, Ad Terra is working on a technical CCUS project for a client in the Middle East, which included formulating a CCUS strategy that focused on identifying approaches that could make the project financially attractive and sustainable in the long run, including a range of financing options. The result was a strategy that aligned with both the client’s financial objectives and the region’s broader environmental goals and therefore, with the right approach, it is possible to unlock value and achieve meaningful climate benefits.

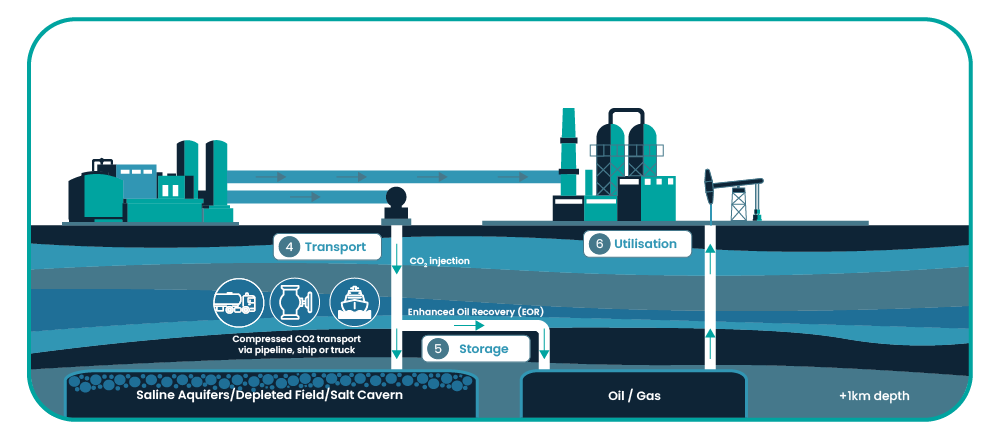

Another avenue for commercialising CCUS mentioned earlier is the utilisation of captured CO2 to create valuable products. Historically, many CCUS projects have used CO2 for Enhanced Oil Recovery (EOR), where the increased hydrocarbon production provided sufficient economic incentives to invest in CCUS. Emerging technologies also offer new possibilities for CO2 utilisation. For example, a consortium led by ETH Zurich, in collaboration with Shell, Holcim and Ad Terra, is exploring the creation of electricity in geothermal cogeneration plants from CO2 injection. By using the specific CO2 properties in useful products or energy, these technologies create value and foster a commercial market for CO2.

The successful commercialisation and implementation of CCUS require not only a deep understanding of the varying regulatory landscapes across different countries but also the ability to craft bespoke strategies that align with these local conditions. Ad Terra can assist companies in navigating complex regulatory environments, developing tailored CCUS commercial strategies, identifying CCUS financing options and aligning projects with regional environmental goals.

About the author

Raeid Jewad, a seasoned energy expert, brings over 20 years of international experience across technical, commercial, and strategic roles within the energy industry. He specialises in carbon management, with particular expertise in CCUS (Carbon Capture, Utilisation, and Storage) commercial and regulatory frameworks, as well as hydrogen and carbon markets.

Raeid is a Visiting Research Fellow at the Oxford Institute for Energy Studies, contributing to their Carbon Management Programme, and previously served as a Senior Policy Advisor in Energy for the UK Government. His academic credentials include a PhD in Materials Science & Engineering from the University of Cambridge, further underscoring his technical expertise in advancing sustainable energy solutions.

Note:

[1] IEA, Net Zero by 2050: A Roadmap for the Global Energy Sector, https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf

[2] OIES, Norwegian CC: What have we learned?, July 2024, Raeid Jewad, Bassam Fattouh and Hasan Muslemani, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2024/07/Insight-154-Norwegian-CCS-what-have-we-learned_.pdf