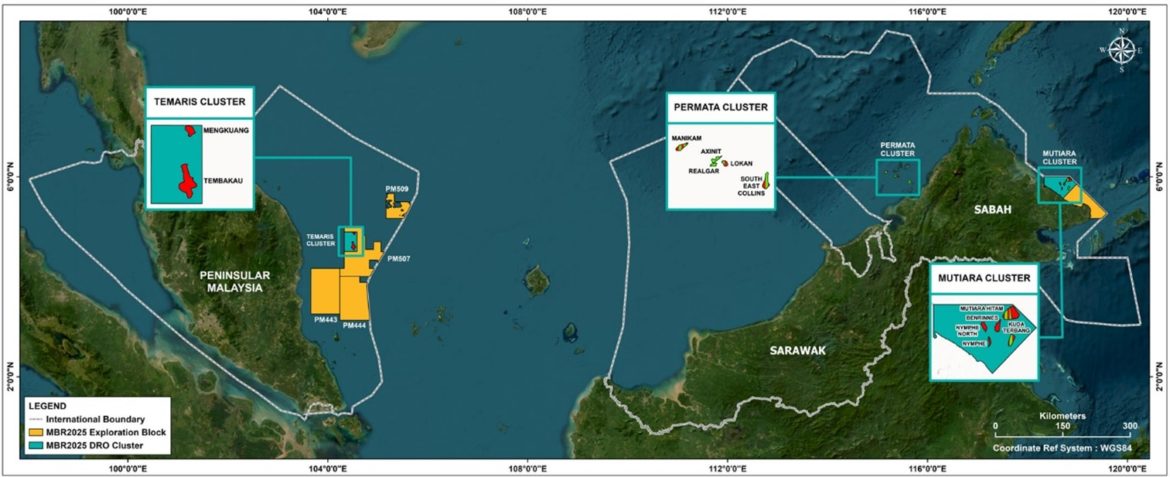

Picture 1. Development and Exploration Blocks

The Malaysia Bid Round 2025 (MBR 2025) marks the latest phase in Malaysia’s efforts to develop its upstream petroleum sector. Launched by Petroliam Nasional Berhad (PETRONAS) through Malaysia Petroleum Management (MPM), this round offers multiple exploration and discovered resources blocks with promising geological features and practical fiscal terms.

Effective development of upstream petroleum assets requires thorough understanding of basin characteristics and geological formations. This assessment informs decisions about project viability, development approaches, and long-term economics. The recent completion of Malaysia Bid Round 2024, which resulted in 14 new Production Sharing Contracts (PSCs) with 12 operators, demonstrates continued industry interest in Malaysia’s petroleum resources.

Ad Terra is ready to provide essential support to companies interested in participating in this bid round, from technical assessment through bid preparation and operational planning.

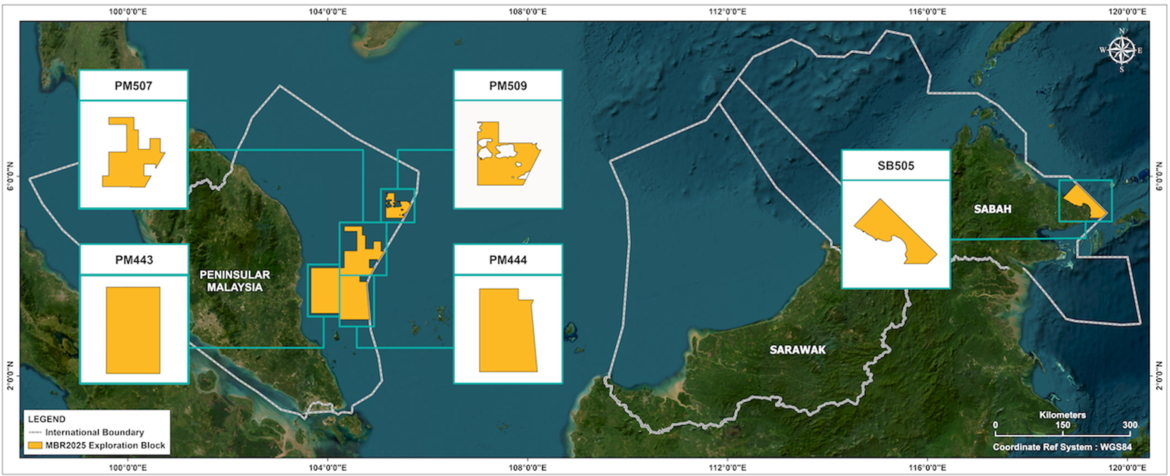

Exploration blocks offered

MBR 2025 presents five exploration blocks across strategic basins:

Peninsular Malaysia (4 blocks)

- PM-507

- Location: Offshore Peninsular Malaysia, eastern side bordering Indonesia

- Area: Approximately 3,500 km2

- Water depth: 30 to 150 meters

- Geological setting: Mature Malay Basin with established hydrocarbon reserves

- Nearby discoveries: Malong-1, Anding-1, Sotong-1, Aji-Aji1-1

- Nearest production facility: Sotong-A

- PM-509

- Location: Offshore Peninsular Malaysia, within the Malay Basin

- Area: Approximately 4,000 square kilometers

- Water depth: 50 to 150 meters

- Geological setting: Mature Malay Basin with established hydrocarbon reserves

- Nearby discoveries: Seligi-1, Bekok-1

- Nearest production facility: Seligi-A, Bekok-A

- PM-443

- Location: Offshore Peninsular Malaysia, within the Penyu Basin

- Area: Approximately 3,800 square kilometers

- Water depth: 20 to 100 meters

- Geological setting: Mature Penyu Basin with established hydrocarbon reserves

- Nearby discoveries: Bertam-1

- Nearest production facility: Bertam-A

- PM-444

- Location: Offshore Peninsular Malaysia, within the Penyu Basin

- Area: Approximately 4,200 square kilometers

- Water depth: 40 to 120 meters

- Geological setting: Mature Penyu Basin with established hydrocarbon reserves

- Nearby discoveries: Bertam-1, Rhu-1,Ara-1

- Nearest production facility: Bertam, Rhu-Ara future development

Offshore Sabah (1 block)

- SB-505

- Location: Offshore northeast Sabah in the Sandakan Basin

- Area: Approximately 2,750 square kilometers

- Water depth: 20 to 500 meters

- Strategic position: Borders SB-405 with discovered resources under Mutiara Cluster

- Nearby discoveries: Mutiara Hitam, Benrinnes, Nymphe, Nymphe North and Kuda Terbang

- Recent drilling: Nymphe-2 ST1 (2008) – gas discovery

- Nearest production facility: Evacuation to onshore Sandakan city or tie in to nearby SB-405 future development

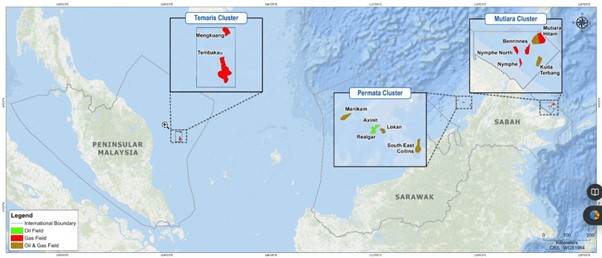

Discovered Resource Opportunities (DROs)

MBR 2025 also includes three DRO clusters in shallow waters near existing infrastructure:

- Mutiara cluster (gas discovery)

- Fields: Nymphe, Nymphe North, Kuda Terbang, Mutiara Hitam, Benrinnes

- Evacuation route: Main gas trunkline to shore near Sandakan city (non-existent), Oil pipeline to shore or FPSO/FSO

- Fiscal term: Small Field Asset Production Sharing Contract

- Permata cluster

- Fields: Manikam, Axinit, Realgar, Lokan, South East Collins

- Evacuation route: Erb West-A Oil Trunkline, Gas Trunkline to Labuan Gas terminal or Sabah Gas Terminal (Sepanggar Bay); Sabah Oil and Gas Terminal (Kimanis) also nearby

- Fiscal term: Small Field Asset Production Sharing Contract

- Temaris cluster

- Fields: Mengkuang, Tembakau

- Evacuation route: Possibly via pipeline to Sotong-A, Malong-A, Anding-A. Possible evacuation in the future through Tembakau field (planned 2028). (offshore-technology.com)

- Fiscal term: Small Field Asset Production Sharing Contract

Fiscal terms

Exploration blocks within the round are offered under the Shallow Water Enhanced Profitability Terms (EPT) Production Sharing Contract (PSC), designed to attract investment in Malaysia’s shallow-water fields (PETRONAS, 2025):

Enhanced Profitability Terms (EPT) PSC

- Cash Payment: 10% of gross production to Federal and State Governments

- Cost recovery ceiling: Fixed 70% of gross production before profit sharing

- Profit sharing mechanism: Based on Profitability Index (PI = cumulative revenue ÷ cumulative cost)

- PI ≤ 1.5: Contractor receives 90% of profit

- 1.5 < PI ≤ 2.5: Contractor’s share interpolated between 90% and 30%

- PI > 2.5: Contractor receives 30% of profit

Discovered Resource Opportunities (DRO) clusters are offered under the Small Field Asset (SFA) Production Sharing Contract (PSC) terms (PETRONAS, 2025).

Small Field Asset (SFA) PSC

- Cash Payment: 10% of gross production to Federal and State Governments

- PETRONAS Share, α%: α% will be set at a minimum and is a biddable item, and fixed throughout the contract period

- Contractor’s Share, β%: β%of Gross Production include all costs (Capex, Opex, Abex) plus Contractor’s profit margins

Comparison between legacy 1997 Revenue Over Cost (R/C) PSC versus EPT PSC and SFA PSC terms (PETRONAS, 2025):

| PSC | R/C PSC | EPT PSC | SFA PSC |

| Cash Payment to Government | 10% of gross production | 10% of gross production | 10% of gross production |

| Cost Recovery Ceiling | Depends on R/C ratio, ranges from 30%-70% | 70% fixed | Simplified fiscal model: β%+ α% = 90% PETRONAS Share, α% (biddable item) Contractor share (Capex, Opex, Abandonment costs and profit), β% |

| Profit Oil / Gas | Depends on R/C ratio, ranges from 30%-80% | Depends on PI, ranges from 30%-90% |

Bid deadlines

- Mutiara and Temaris clusters: March 13, 2025

- Permata cluster: June 16, 2025

- Exploration Blocks:

| Explorations Blocks | Basin | Bid Closing Date | Fiscal Term |

| SB505 | Sandakan Basin, Sabah | 30 August 2025 | Enhanced Profitability Terms |

| PM507 and PM509 | Malay Basin, Peninsular Malaysia | 01 December 2025 | Enhanced Profitability Terms |

| PM443 and PM444 | Pensy Basin, Peninsular Malaysia | 01 April 2026 | Enhanced Profitability Terms |

Get our assistance before the bid deadlines

Ad Terra Consultancy can assist companies interested in these opportunities through:

- Dataroom technical assessment and feasibility studies: Evaluation of geological potential, resource estimates, and development concepts

- Economic modelling: Analysis under EPT terms to forecast potential returns

- Bid preparation: Development of competitive bid documents and strategies

- Operational planning: Support for exploration campaign planning and execution

- Field development: Solutions for developing discovered resources effectively

Contact us today to discuss how we can help you evaluate and develop a winning bid strategy for the Malaysia Bid Round 2025:

- Ad Terra Email:

- MBR 2025 Website: https://www.petronas.com/myprodata/mbr

Contact us today to ensure you have adequate time for comprehensive bid preparation.

About Ad Terra Consultancy

Ad Terra Consultancy provides energy-related technical expertise to clients worldwide, including on upstream petroleum projects. Within Asia-Pacific, Ad Terra Asia, our regional branch, has a successful track record in offering technical support with commercial practicality to deliver actionable insights throughout the lifecycle. From exploration strategy to field development planning, our team helps operators and investors make informed decisions that enhance portfolio performance and operational success.